In a new binding answer, the Danish Tax Council concluded that a sale of shares to its own holding company followed by a liquidation did not constitute circumvention of section 3 of the Danish Tax Assessment Act, as the questioner was resident in a DBO country.

Section 3 of the Tax Assessment Act contains a general circumvention clause whereby companies, etc. must, when calculating income, disregard arrangements that are organised with the main purpose of obtaining a tax advantage that counteracts the purpose and intention of tax law.

In a new binding answer, a decision was made as to whether a specific arrangement in connection with the liquidation of a company could be regarded as circumvention. In the case, A and his son B were resident in a DBO country. A and B jointly owned the shares in a Danish company AB Holding (ABH). In addition, A and B indirectly owned all the shares in their respective Danish holding companies A Holding (AH) and B Holding (BH).

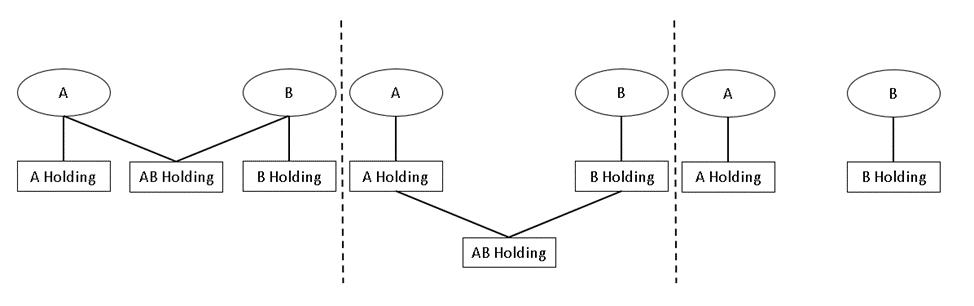

A and B wanted to liquidate ABH, but such liquidation would result in A and B being subject to dividend tax on the liquidation proceeds as the DBO country was neither a member of the EU nor the EEA. Therefore, prior to the liquidation, A and B transferred their shares in ABH to AH and BH respectively for consideration in a claim, after which ABH was liquidated.

The individual steps can be simplified as follows:

The question was then whether the arrangement was considered circumvention within the meaning of section 3 of the Tax Assessment Act.

The Tax Council confirmed that the transfer did not result in dividend taxation for A and B under section 2(1)(6) of the Withholding Tax Act, as A and B were resident in a DBO country that has both a DBO and an agreement on the exchange of tax information with Denmark.

Furthermore, the Tax Council confirmed that the arrangement was not covered by the circumvention provision in section 3 of the Danish Tax Assessment Act, as the arrangement was not found to be contrary to the purpose of the tax legislation. The background to this was that the legislator had chosen in domestic Danish law that section 2(1)(6) of the Withholding Tax Act should not apply to holding sales when the shareholder was resident in a country with which Denmark had a double taxation treaty and which had an agreement with Denmark on the exchange of information, as it was assumed that the person would be taxed on profits in the country where the person was resident.

The decision shows that even if one of the purposes was to avoid a tax trigger in Denmark, the “arrangement” could not be set aside under the general anti-avoidance clause in section 3 of the Danish Tax Assessment Act where the legislator had chosen to regulate the specific relationship and had not expressly chosen to insert a defence against such transactions.

The decision also establishes the value of a binding answer in which the framework for a complicated construction is outlined to the Danish Tax Agency and thus does not have to be worked out in a subsequent control case. It is thus our recommendation that you secure yourself through binding answers or tax reservations so that unnecessary and unforeseen taxation is not triggered in connection with a reorganisation.

Bachmann/Partners Law Firm advises on restructuring and tax law transactions, and we have extensive experience in preparing binding responses.

For further information, please contact Christian Bachmann on tel. +45 30 30 45 21 / chb@bachmann-partners.dk, Ann Rask Vang on tel. +45 20 94 78 21 / ava@bachmann-partners.dk or Peter Hansen on tel. +45 40 32 35 35 35 / pha@bachmann-partners.dk.